Transforming capital market operations and roles

Blockchain technology can have a dramatic effect on how capital markets function by providing common standards that are unified, highly-secure and able to reduce the risks associated with storing and maintaining databases of asset ownership and transactions.

In the video below, we outline some of the key operational challenges that can be solved in capital markets using blockchain infrastructure. We then identify how existing roles might be changed and new ones created.

How capital markets operate

The nucleus of activity that takes place in capital markets revolves around the storage and maintenance of datasets relating to asset ownership and financial obligations.

With trillions of dollars of securities and obligations exchanged daily, the current methods for doing so and the market infrastructure that enables these functions are highly complex, suffer from a lack of common standards, and utilize fragmented IT solutions and data architectures.

This increases risks for financial institutions who must continually engage in costly data and process duplication and reconciliation. The end result is increased systemic risk, a higher cost of capital than is necessary, and the exclusion of some participants from accessing the capital they need.

Opportunities for Blockchain Technology in Capital Markets

Blockchain improves capital market operations

Through the creation of a shared platform for collaboration and by using smart contracts, blockchain or distributed ledger technology can address the challenges associated with sharing data efficiently and alleviating the need for constant reconciliation.

This shared infrastructure and smart contract capability can also help to automate a significant amount of administrative work inherent to capital markets.

Which roles exist in blockchain-based capital markets?

Most traditional roles such as brokers, exchanges and asset custodians will continue to exist in a blockchain-based capital market in the near to mid-term future and their ability to function will likely be enhanced.

However, the shift to blockchain-based capital markets also necessitates the emergence of new roles. With the introduction of blockchain into the technology stack of capital markets infrastructure, many of these roles will likely need to adapt in the long term.

Some of the important roles that are emerging now and will increase in future include:

- Digital Asset Vault

- Asset Tokenizers

- Digital Asset Registrar

- Gatekeeper

- Cash-on-ledger issuer

- Cash tokenizer

You can find out more about blockchain's role in capital markets by watching the other videos in our series or by viewing some use cases for blockchain in capital markets, via the links below.

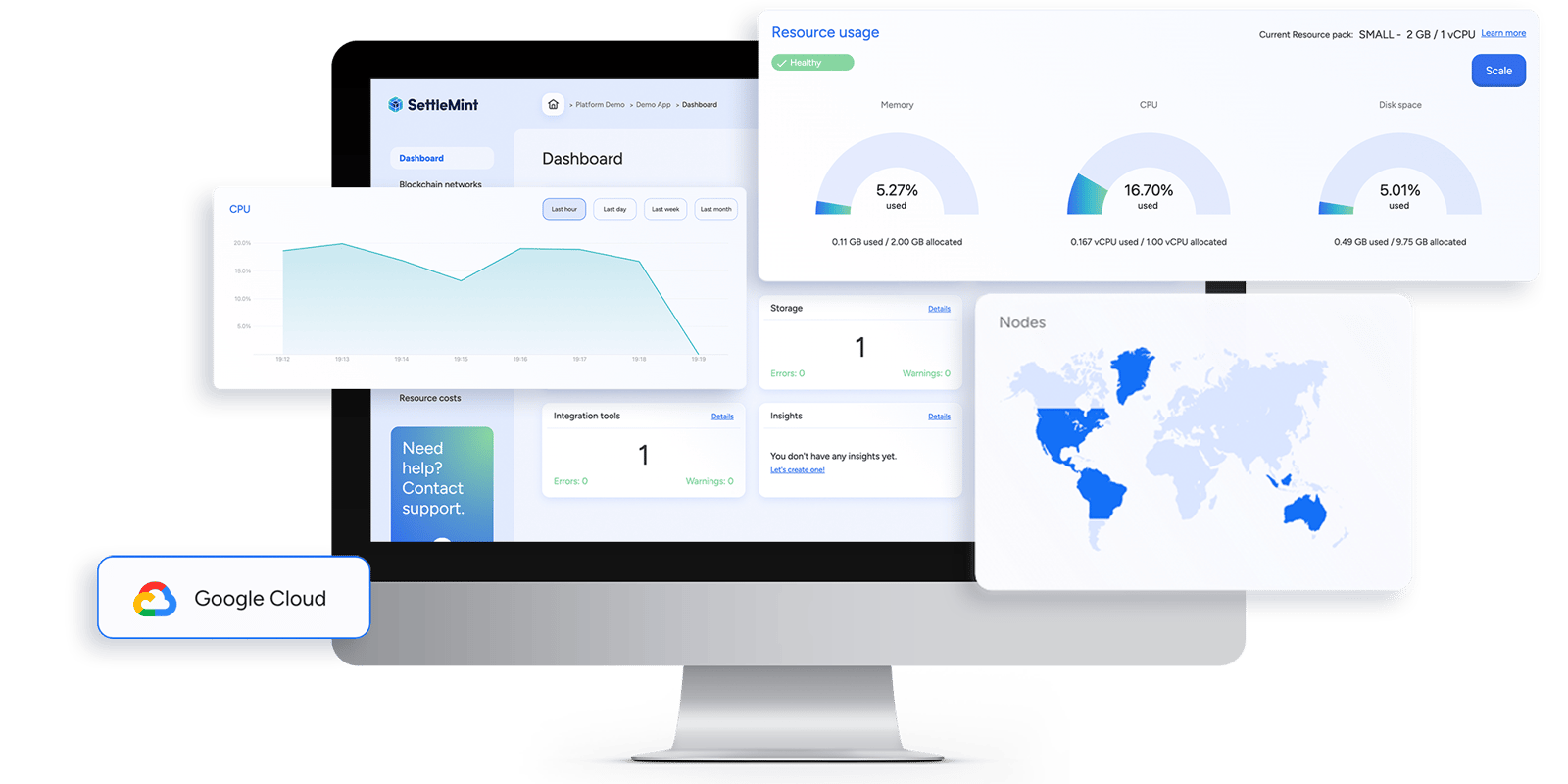

Discover the technology behind the stories

The Blockchain Transformation Platform that enables you to innovate with blockchain incredibly fast.

Read more blockchain innovation stories

Use case: The benefits of blockchain in capital markets

Demo: How to tokenize assets with SettleMint