Standard Chartered increases trading efficiency for institutional investors

Reinvented customer experience

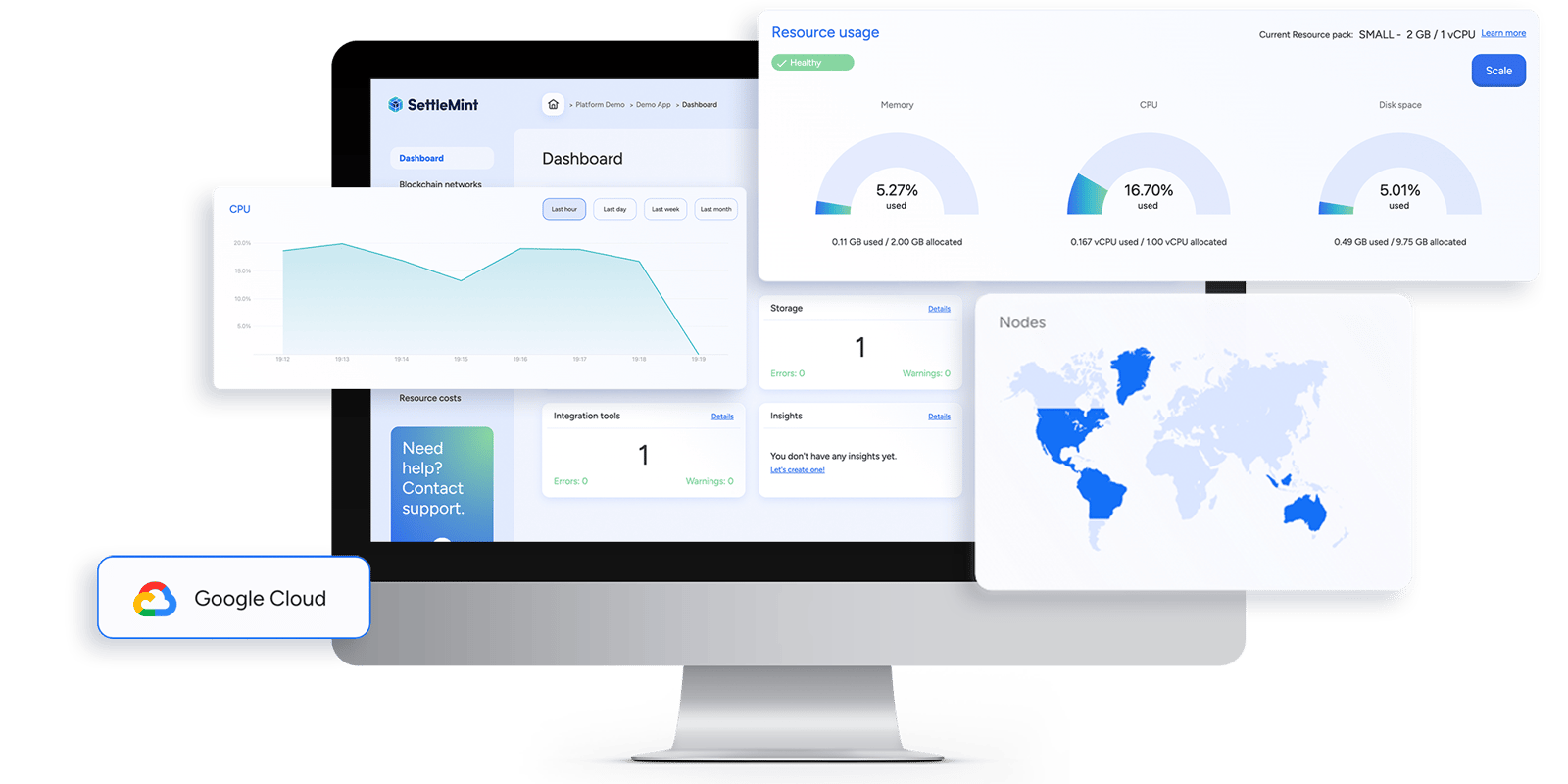

The virtual exchange is designed to increase trading efficiency for institutional investors. Assets are issued on the underlying DLT and changes in ownership of assets are recorded instantly and immutably. Transactions on the exchange are settled in seconds rather than days with the exchange operating 24/7. This removes risk by dramatically shortening clearing & settlement time and cost while enhancing both transparency and liquidity for clients.

The Digital Virtual Exchange, which supports fractional tokenization of various security types (e.g. shares, bonds, currencies) opens up a whole new world of trading possibilities for the institutional investors and promises to bring a new and improved digital customer experience.

Substantial savings

By eliminating the need, and thus associated cost, for an intermediary to provide custody services, Standard Chartered stands to benefit from substantial savings.

Moreover, as the market can operate 24/7, clients have greater flexibility.

Standard Chartered drastically improved clearing & settlement time and cost while enhancing both transparency

while creating potential liquidity for their clients.

Read more blockchain innovation stories

VIA Don Bosco brings full transparency to donation spendings

Islamic Development Bank supports financial inclusion

Indonesia secures elections results and speeds up reporting

Discover the technology behind the stories

The Blockchain Transformation Platform that enables you to innovate with blockchain incredibly fast.