Standard Chartered increases trading efficiency for institutional investors

Impact Overview

- Reduce clearing & settlement times from days to seconds

- Enhance client transparency and liquidity

- 24/7 transaction availability

Challenges

Leading the Market

Standard Chartered offers international banking services in some of the world's most dynamic markets, including Asia, Africa and the Middle East.

Meeting Consumer Needs

Increasing trading efficiency and bringing improved customer experience for institutional investors.

Procedural Optimizations

Reducing costs associated with intermediaries.

Solutions

- A blockchain-based Digital Virtual Exchange, which supports fractional tokenization of various security types (e.g. shares, bonds, currencies).

- Assets are issued on the underlying blockchain and changes in ownership of assets are recorded instantly and immutably.

- By eliminating the need, and thus associated cost, for an intermediary to provide custody services, Standard Chartered benefits from substantial savings.

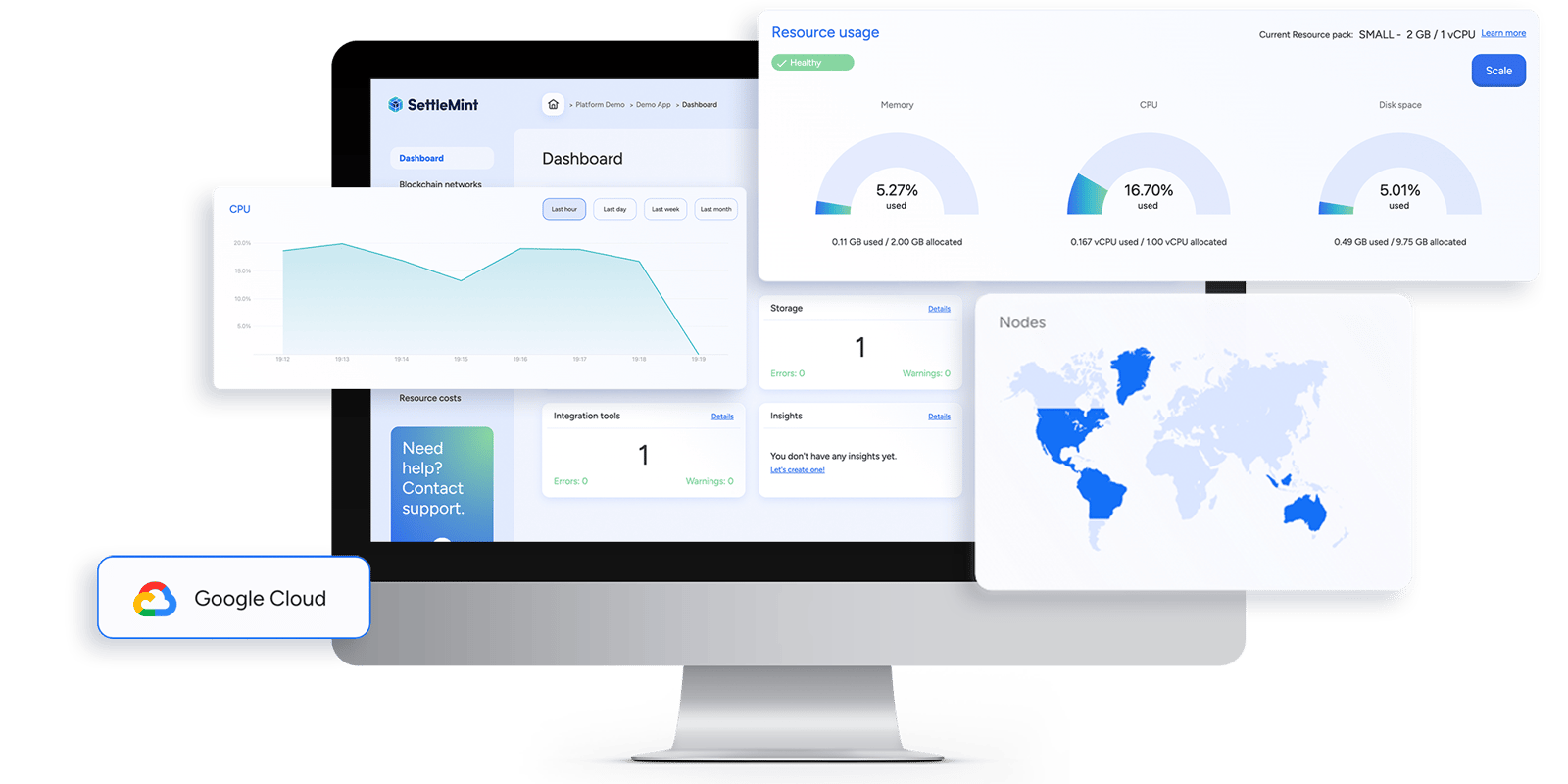

Discover the technology behind the stories

The Blockchain Transformation Platform that enables you to innovate with blockchain incredibly fast.

Read more blockchain innovation stories

VIA Don Bosco brings full transparency to donation spendings

Islamic Development Bank supports financial inclusion

Indonesia secures elections results and speeds up reporting